I talk a lot about market research in practice in marketing, but don’t always take enough time to discuss the nuts and bolts of it all. I figure it’s important, which is why I did the obvious thing….

Before you scroll down, why not sign up for my email updates? Get every article direct to your inbox!

…created a fun quiz-style game show to help you, masterful marketer reading this blog, make sure your market research nuts and bolts knowledge is in tip top shape!

That’s right, I’ve created a market research quiz, and I want you to take it! Not only that, I want to know how well you did, so be sure to post your score in the comments section below.

What’s that? You’re not quite ready to take a market research exam? Well, have I got a solution for you. Below, I’ve put together a great study guide and overview of many of the nuts and bolts of market research I just mentioned. Take a quick read, get yourself pumped up, and get ready to take the Market Research Master Quiz!

Scroll to the bottom to take the quiz!

Take the Practice Market Research Quiz first!

Are you a marketer who’s unsure if they know enough about market research to take the quiz right? Get started with this practice quiz! If you get everything right, scroll

To get started, take this practice quiz to see how you’re doing. If you get all 6 questions right, scroll on down to the end and get started on the exam! If you score 5 or less, then simply scroll down to the sections you need refreshers on and get yourself ramped back up!

Practice Quiz!

Different Data for Different Days

When it comes down to it, market research is all about making sense of data. Sometimes that’s numbers, sometimes it’s articles, sometimes its spoken words from your direct audience, and many more options in between.

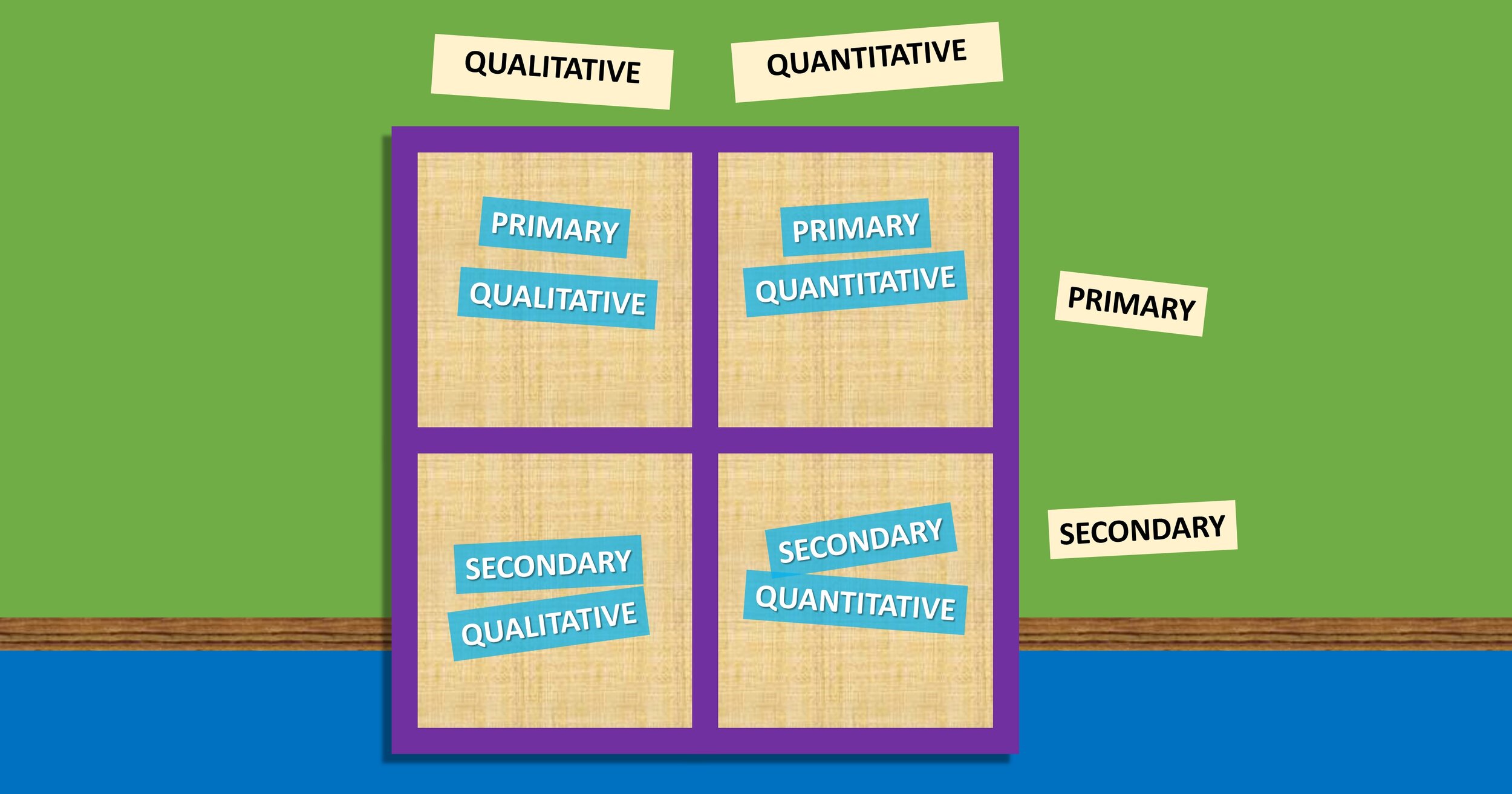

But to really communicate in the language of research, you need to know what where your data fits on the grid:

Using this framework, we see that data really fits into four categories:

Primary Qualitative: Deep, rich data that cannot be measured, that you go out and secure yourself.

Primary Quantitative: Measurable data, like numbers and scales, that you go out and secure yourself.

Secondary Qualitative: Deep, rich data that cannot be measured, that was collected bysomeone else before this project.

Secondary Quantitative: Measurable data, like numbers and scales, that was collected by someone else before this project.

If that sounds a bit formulaic, there’s a good reason for it. Let’s dive into each of the four basic data types to figure out what it all means.

What is Primary Data in Market Research?

Primary data is any data you go out and gather yourself.

As you’re conducting market research, primary research might mean conducting a marketing survey, hosting focus groups, observing your audience out in the wild…literally any type of information you specifically ‘go out and get’ for this current project at hand.

It makes sense why you would do this, right? It’s your audience, your specific marketing question, and going directly to the source to get your info is exactly how you’re going to get big, great, true market research insights.

There’s no question, primary data is extremely powerful for market research for marketers.

So what’s the catch? Well, it’s you doing it, that’s the catch. See, gathering data yourself can often take some time, and adds on expenses too. And if you’re like most of the marketing masters I’ve worked with in the past, time and budget are rarely on your side.

What’s the alternative, then, when you need to find a quicker-turnaround option that doesn’t break the bank? Well, you might say there’s a secondary option.

What is Secondary Data?

Secondary data is any data that already exists.

When you’re conducting market research, using existing data sources – like survey results from industry associations, expert opinion articles, and even public data sources like the U.S. Census – will often save you time and energy. The data’s there, you can immediately hop into understanding-your-data-mode and begin to map out your marketing journey.

What the challenge then? Why not go the secondary research route at every step of the way to save both time and energy? Well, there’s a good chance the answer to your specific question isn’t exactly out there.

In a lot of marketing and market research situations, you’re trying to answer a pretty specific set of questions. There’s a good chance that question hasn’t been asked before, not specifically for your exact audience or market or conditions. And if it has, there’s a good chance it was asked and answered by a team not always willing to share.

Secondary, instead, is powerful in helping you figure out answers, derive solutions and piece together analyses. You might not be able to measure with secondary data how often teenagers eat burritos, but you can probably find out how often anyone eats burritos and how often teenagers eat at Mexican restaurants, and make some judgement calls.

What is Quantitative Data in Market Research?

Quantitative data, or ‘quant’ data, is anything you can measure. Put more eloquently, it’s numbers.

When most people think of ‘data’ in the traditional term, they’re thinking quant. It’s averages and medians, it’s net promoter scores and mean household incomes and shares of market.

Think about a survey data-set, where you ask everyone to rate how much they like or dislike both you and three competitors. Imagine it’s on a 1 to 10 scale. And let’s say you ask 1,000 people to take this survey.

That’s quant data. It’s you having real, measurable figures in front of you that, unbiased, can tell you a story that pertains to your marketing.

What’s the advantage? Well, if you consider yourself a ‘numbers person’, you’ll immediately know. Numbers don’t lie. They tell the facts, and in large enough quantities, can often reveal some pretty cool truths. How does your total audience really feel about your brand? What is the true likelihood that your target market will convert to a customer? You can use math to measure and evaluate each of these points, and make some pretty cool stats-based decisions from the results.

The downside then? Well, it’s twofold. One, you need to make sure your data is true to your point and really answers the question. That can be tricky sometimes when you’re trying to create numbers, especially if you’re writing a survey and trying to keep the responses unbiased.

The second? Not everyone’s a numbers person, and that’s especially true with some marketers. I’ve known a lot of creative pros, writing pros, etc., and they all stare at me blankly when I speak to them about the science of statistics.

So while quantitative data is probably a huge opportunity for your market research, whether that data’s primary or secondary, it also needs to be useful for your marketing purposes.

What is Qualitative Data in Market Research?

Qualitative data, or ‘qual’ data, is rich, introspective information that you can learn a lot from, but cannot measure.

Have you ever wondered “how are they going to measure that focus group?” Well, they probably aren’t. Market research techniques like focus groups, in-depth-interviews with your audience and more are phenomenal at finding out much much more about how your audience thinks and feels. But it’s all a bit subjective, as the response counts are usually too small and the information gathered in no way measurable against each other.

Let’s say you read a phenomenal article about your audience, written by one of the foremost experts in the people-who-market-to-your-audience world. There’s obviously going to be a ton of great insights in there, which is critical for market research. That’s great qualitative data.

Let’s say you work in B2B marketing, working mostly with CMOs, and you host two two-hour conversations, each with ten CMOs, one current customers, one lapsed or only stayed as a lead. The conversation itself would be excellent qualitative data.

It’s rich, it’s informative, and it’s excellent to planning the backbone for your next marketing strategy.

So what’s the catch? Well, without measurement tools, it’s easy to find the diamonds among the rough in qualitative data.

While 30 minutes of your three hour CMO conversations might be amazing, the remaining two and a half hours might not be as useful. Identifying those 30 minutes – because they might not be the most obvious – can be a challenge.

Worse still? There’s a good chance one person in that group might say something extremely powerful that just doesn’t apply to the rest of the audience. And if no one spoke up, you can end up taking your marketing down a rabbit hole based on one client’s comment.

The challenge of not using numbers in market research is that it’s difficult to take the bias out of the information, or even in making sense of it all in the end. While rich and filled with ideas and inspiration for marketing, qual data requires a lot of attention and consideration to really make it work for marketers.

Which is right?

So what’s the best? Primary qualitative data? Secondary quantitative data?

The answer, really, is what’s good for your situation. If you have plenty of existing data available, secondary might be the way to go in some cases. In others, if you have a few weeks for the whole project and access to a few resources, conducting a primary research study might give you even more incredible ideas than you could have ever imagined.

The situation is going to change on a case by case basis.

The best solution? Keep yourself aware of all four data types, and evaluate each marketing challenge to decide the right types of data for your specific market research project!

What is an Insight in Market Research?

I’ve defined insight plenty of times on this blog, but because it’s always important to keep this vital marketing tool in mind, let’s revisit the topic once more!

Marketing insights are deep information about markets and audiences that increase our ability to create deeper relationships through better marketing. It’s everything from habits and rituals in our audiences’ lives, to the values and beliefs that dictate their decision making.

Insights are the word we use to define meaningful insider information about who we’re trying to communicate with.

An insightful advertising campaign is one that targets audiences with messaging that resonates with their minds, displayed in settings where they’ll be most mindful.

An insightful digital campaign is one that shares multiple messages over time, leading our audience down a path from awareness, to interest, to engagement, to conversion, all while building a real relationship with the prospect.

An insightful marketing strategy considers where the customer is in their individual buying process, and how that customer likes to make their purchasing decisions.

What is Market Research?

To close it out, I wanted to give one final important definition before we head into the quiz – a great definition for market research for marketing!

Market research is the process of gathering information to make your marketing better.

Simply put, when we spend time learning, gathering relevant information, and taking the time to apply it to our marketing strategies, they get better. They become more targeted, more cost effective, and more meaningful in the end.

Whether that process involves gathering secondary research information or conducting a primary research study, the addition of a market research strategy to any marketing process is an exercise in improving the final marketing outputs.

Are you ready to take the Market Research Master Quiz?

Alright, let yourself get loose, and get your brain focused. You’ve read the required reading, aced all the practice tests, and now it’s time to put your market research knowledge to the test!

Are you ready? Great! Because it’s time to prove yourself a Market Research Master!

Great luck to you masterful marketer. Be sure to post your final score in the comments section!

Take The Quiz!

So, how’d you do? Be sure to post your percentage score in the comments!